KARL MARX THOUGHT capitalism was destined to die. 150 years ago, he predicted in Das Kapital (1867), “capitalist production begets, with the inexorability of a law of Nature, its own negation” and “the expropriators are expropriated.”1

Concentrating outsize wealth in the hands of “a few usurpers” did not look like a sustainable system to Marx, given the historical backdrop of the political and social revolutions from 1789 to 1848. So, in history’s last act, the proletariat rebels, expropriates the one percent, inaugurates a communist society, and lifts the darkness of capitalism for good. Yet dark capitalism is by no means doomed capitalism.

The doom of capitalism was a hope for Marx and a fear for others. Political economist Joseph Schumpeter worried in 1942, “can capitalism survive?” The retiring writer of The Economist’s “Schumpeter column” contemplated the endurance of capitalism recently too. Noting low productivity growth since the 1970s and mounting dysfunctionality of democracy in rich Western countries, he faulted the “toxic brew” of populism for “rapidly destroying the foundations of the post-war international order and producing a far more unstable world.”2

I am concerned about the downsides of capitalism, not its demise. My worry is rising inequality, such as the spiraling problem of wealthy people and their offspring marrying the children of other winners and hoarding the best educational opportunities. This chapter will thus consider dark capitalism defined as a political economy in which the twin harms of inequality and alienation rise unchecked. Both ills can and should be controlled. A capitalist society worth its salt must fulfill the American constitutional goal and create happiness for ever more people.

CAPITALISM IS A global economic reality in one way or another. Various forms of capitalism are competing around the world. There is no globally uniform capitalism. Hence, we should adjust our language to capitalism in the plural. Speaking about capitalism in the singular is a misnomer and an obstacle to reform.

Regional capitalisms would be an appropriate term. It casts a net neither too wide nor too narrow and catches distinct national and transnational formations of capitalism, i.e. privately owned means of production for profit.

Various forms of capitalism have developed historically, henceforth alternative capitalisms could be designed strategically. Take, for example, the Chinese and American models; their differences are substantial and demonstrate the protean nature of the family of capitalisms. A given species of the genus capitalism could therefore serve as a springboard from the empirical to the normative, from a particular capitalism to what a humane capitalism could and should be.

Rising inequality lowers the resistance of democratic societies against populism, but rising inequality is a controllable feature of capitalism. There are no iron “laws of nature” that prevent a society from designing a capitalism with low inequality. Cushioning the divergence between haves and have-nots with social welfare elements would be a good start.

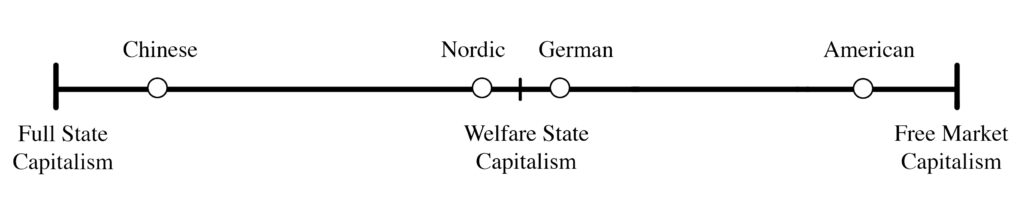

Figure 1 shows Chinese, Nordic, German, and American capitalisms mapped from left to right. The extreme left indicates a market economy under full-fledged state leadership and the extreme right a market economy free of any external control or direction. All four regional capitalisms are Weberian abstractions from existing economies and both ends are purely theoretical. Their positions are not determined by any metrics, only by their proximity to one or the other theoretical extreme, and, in the case of the two center-left and center-right welfare state models, on their relative equidistance to both polar ends.

The Chinese model of capitalism features state-sponsored capitalism in a single-party state. Focused on attaining the overall goal of socialism, the Chinese economy is officially termed a “socialist market economy” in which market forces play a “decisive role”3 – up to a point. China has not handed state power over to the markets, except for some small and insignificant rural ones. Markets may challenge the state, but the renminbi (“people’s currency”) stops at the executive desks of the Communist Party of China (CPC).

The economic toolbox of the CPC includes both active and passive state interventions. It was passive intervention during the Deng Xiaoping era when market forces were “allowed” to play an important role in China. Active intervention was on display in the summer of 2015, when Beijing supported its crashing stock market with a slew of countermeasures and a news blackout. The economic power of the state is both a Chinese and a distinctive regional feature.

American capitalism strives to be pure. Governmental regulation of the economy is frowned upon. Attuned to the wants and whims of heartless markets, US capitalism shirks compassion and favors management autonomy, foremost the ability to hire and fire. Competition between everybody, including company staff, is also paramount.4

Radical change and innovation are the hallmarks of American corporations such as Amazon, Airbnb, Facebook, and Uber. The US model vilifies non-market coordination, perceives social commitments as socialist and tries to avoid or eliminate them. Popular support for this model is robust and reaches deep. The wealth of a selfish billionaire is largely viewed without envy, while mechanisms that would help the poor are perceived as harmful “rigidities.” Handing benefits to “unproductive economic agents” appears to be unreasonable and un-American.

The opposed Chinese and American economic models are met near the middle of Figure 1 by the Nordic and German welfare state capitalisms, which are closely related.

The Nordic ensemble includes the economies of Denmark, Finland, Iceland, Norway, and Sweden. Nordic capitalism combines a free market economy with state supervised collective bargaining between capital and labor and the benefits of a comprehensive welfare state. The Economist once called the Nordic countries the “next supermodel” and noted, Nordic capitalism has managed to avoid “southern Europe’s economic sclerosis and America’s extreme inequality.”5

The German model of capitalism has a strong vocational tradition (apprenticeship system), which combines practical work with classroom education, and, most importantly, gives workers the right to “co-determine” the decision-making of the companies they work for. Co-determination (Mitbestimmung) ranges from the board of directors to the shop floor. It aims to balance the profit motive with the interests of labor by putting trade union representatives on company boards and works councils (Betriebsräte).

In the tug of war between economic efficiency and social justice, Germany nurtures a capitalism that prefers to err on the side of social justice. Ranked third largest export economy after China and the US, German capitalism radiates outward through global exports from European Union members to America and Asia as well as the other parts of the world.

Collective social support for poor and distressed citizens is not only possible but also prudent. The Nordic and German welfare state capitalisms show that nations can do well and be competitive in economic terms while still caring for fellow-citizens who are not well-to-do or have other needs they cannot handle on their own. Benefits and drawbacks of caring and uncaring capitalisms are evidenced by vastly different world happiness scores.

THE WORLD HAPPINESS Reports of the UN underscore the leadership in wellbeing of the Nordic countries (Table 1). Nordic group members have been trading places, but are consistently in the top 10, Denmark on the high and Sweden the lower end. Iceland came up from below in 2013 but has kept a top 10 score since then.6

The group of five countries following the Nordic team is recurrent in the top 10 as well. Led by Switzerland, this group does not have a clear commonality. Other than these ten happy countries, only Ireland, Austria, and Luxembourg broke into the top ten: Ireland in 2012 (no. 10); Austria in 2013, 2019, and 2020 (nos. 8, 10, 9, respectively); Luxembourg in 2020 (no. 10).

Table 1 calls for a couple of comments. First, the top 10 countries are big in wealth and small in population. Altogether, the five Nordic countries comprise not more than 27 million people. The next five countries are again similar in both respects. They are rich and their population total amounts to ca. 90 million people – a bit more than Germany (81 mill.), far less than the US (325 mill.), and a lot less than China (1,374 mill.). To hazard an explanation for the top 10 habitués, I would say the pursuit of country happiness requires prosperity, is helped by a small population and hampered by a big one. It seems probable that population size eases or aggravates good governance, too.

Second, the US and Germany are both in the top 20. The US has always been there, Germany since 2016. Germany has made some big strides towards achieving a happy country, though not to the degree of the Nordics. The difference between the US and Germany in overall happiness has shrunk and is now close. Yet the US has fallen from rank 13 in 2016 to 14 in 2017 and is showing a structural weakening that is not economic but social. Economist Jeffrey Sachs, leading author of the World Happiness Reports, has called America’s declining happiness “a roiling social crisis that is getting worse.”7 China has moved in the right direction but must still go much further to make its people as happy as those of China’s advanced counterparts.8

Six variables determine a country’s score by measuring people’s subjective wellbeing or happiness:

- income per capita (1) and life expectancy at birth (2) provide information about material conditions

- social support (3) and perceived corruption in government and business (4) describe social capital

- donations (5) gauge individual values

- freedom (6) grasps individual and social factors, such as personal wealth and skills, democracy and civil rights.

Regarding America, Sachs found the first two variables, which measure economic conditions, have moved the US towards greater economic happiness, but the last four, which measure social conditions, have deteriorated. Noting the “US showed less social support, less sense of personal freedom, lower donations, and more perceived corruption of government and business,” he concluded, “America’s crisis is, in short, a social crisis, not an economic crisis.”

Currently, all the wrong solutions to prevent this crisis from deepening in the US are vigorously pursued. Trump and Trumpism are boosting American “greatness” in all the wrong places. Tax cuts for the superrich exacerbate inequality. US social safety nets are cut. Public education is underfunded. Infrastructure is pitched rhetorically but let go to rot. The environment is stripped of protections; big money is allowed to distort elections; fear of immigrants and refugees is stoked; distrust is encouraged; and the country’s already unmatched hard military capabilities are bulked up at the expense of its soft power strength.

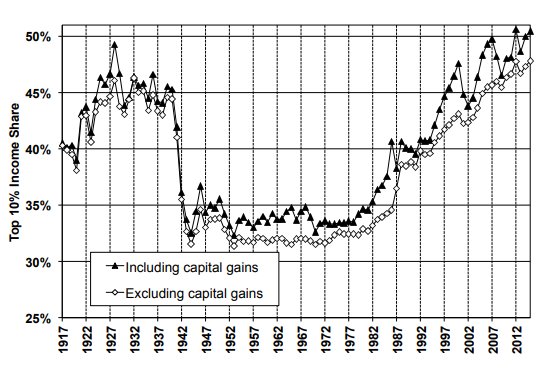

Although material conditions in the US are still heading in the happy direction, I do not count on that trend continuing under the auspices of isolationism and protectionism of “America First.” The inegalitarian spiral started in the US in the late 1970s (Figure 2) and has taken root with supersalaries for top managers and growing inheritance flows. Rising inequality has been hitting lower-income white-collar and blue-collar workers ever since. Republicans scorn spending tax dollars on the country’s social and natural capital. Private wealth has spun out of control.

Thomas Piketty, the French economist who has investigated the historical dynamics of capital and capitalism as thoroughly and deeply as only Marx before him, has flagged the “considerable transfer of US national income … from the poorest 90 percent to the richest 10 percent” as a huge socio-economic problem and warned, “it is hard to imagine an economy and society that can continue functioning indefinitely with such extreme divergence between social groups.”9

Figure 2 shows only data from tax returns. Dark money in tax havens is unaccounted for. The sharp rise of US incomes since the 1980s would probably be much steeper if these hidden riches could be included. Nevertheless, the trend is clear. Accumulation of American wealth has shifted to the top 10 percent, especially 1 percenters and higher.10 The 90 percent “bottom” of the US population is excluded from the nation’s economic growth.

If we consider the total growth of the US economy in the thirty years prior to the [financial] crisis [of 2008], that is, from 1977 to 2007, we find that the richest 10 percent appropriated three-quarters of the growth. The richest 1 percent alone absorbed nearly 60 percent of the total increase of US national income in this period. Hence for the bottom 90 percent, the rate of income growth was less than 0.5 percent per year. These figures are incontestable, and they are striking.11

The economic “good old days” are long gone. The thirty-five years from 1942 to 1977, when the rift between rich and poor was not that stark because the upper 10 percent of the United States appropriated maximally only 35 percent of US national income, are history. The more egalitarian American society of the postwar is unlikely to return.

Great wealth in the eighteenth, nineteenth, and early twentieth centuries was mostly inherited and passed on. Derived from returns on capital (dividends, interest, rents), it fostered an upper class of rentiers in, as Piketty called it, “a hyperpatrimonial society.”12 Yet when a novel engine of wealth concentration – supersalaries for top managers – was added to the mix in the last decades of the twentieth century, a new driver of inequality was activated.

Vast wealth from labor was pioneered in the US and is spreading to other countries now. Extremely high salaries and multi-million-dollar bonuses for top executives have quickly become the norm, even for CEOs who underperform. Piketty has termed the compensation of supermanagers “hypermeritocratic” and said dryly, what “merits” a supersalary and to what height is only evident to the lucky beholders but otherwise hard to tell.13

The future of rising inequality looks bright from a winner’s perspective. Supersalaries rivaling incomes from inherited wealth are building new fortunes. These, in turn, yield additional profits, namely the earnings from recently amassed capital, usually invested in real estate, industrial or financial assets. Thus, high income from labor seeks additional revenue from capital. And since “there is no reason why a person can’t be both a supermanager and a rentier” (Piketty), combined industrial power and financial wealth explode brilliantly.

Welcome to the future of dark capitalism! It promises a superinegalitarian society. To make things worse, this dystopian society has a strong tendency to endure if income from capital (r) trumps the growth of the economy (g), or r is greater than g. In a mature economy like the American with low population growth (under 0.8 percent presently), an annual increase of GDP hovering around 2 percent, and a general rate of return on capital in the neighborhood of 5 percent, new investments and savings add up significantly and progressively.

Robert Mercer (discussed in the previous chapter) is a perfect example for the inegalitarian force of r > g. A highly paid supermanager who is also drawing a considerable rent from accumulating capital, he is bound to get richer and richer. He occupies a supersalaried position at Renaissance Technologies and profits handsomely from investing and re-investing part of his income and wealth into the firm’s secretive Medallion Fund, which is open to Renaissance employees only (around 300 people). Forbes listed Mercer’s 2016 earnings with 125 million dollars. The income of the firm’s founder was twelve times as much: Jim Simons “earned” 1.5 billion dollars in 2016.

These two outsize numbers, the big and the bigger one, exhibit the logic and tell the story of neo-patrimonial capitalism. Sooner or later, Mercer, too, will break into an annual income of one billion. His children and grandchildren, denizens of our nouveau superinegalitarian society, have already no need to work for a salary anymore, they may, but not because they must.

Bannon found unlimited wealth for very few people so “disturbing” that he dreamed of an enlightened Christian capitalism – but for whom is he working? The families of his origin, the forgotten working class? Or the families of his superwealthy patrons? As Trump said, Bannon is simply “a guy who works for me.”

If Bannon would have been serious about a capitalism reflective of Christian values – Matthew 19:24 perhaps, “It is easier for a camel to go through the eye of a needle, than for a rich man to enter the kingdom of God” – he could have tried to interact with and learn from the spiritual leader of Catholicism, Pope Francis. Instead, when Bannon went to Rome in 2014, he was already “suspicious” of Francis.14 Seeking out Cardinal Burke, the Pope’s vocal opponent, Bannon aligned himself with an archconservative Catholic reactionary. Whatever Bannon was wary of, it was probably confirmed the following year by the encyclical letter Laudato Si’.15

ACLARION CALL for global social and environmental justice, the Pope’s Encyclical Letter amplified “both the cry of the earth and the cry of the poor.”16

Pope Francis underlined, “the human environment and the natural environment deteriorate together.” He charged all regional capitalisms to combat “human and social degradation” with investments in their nations’ social and natural capital. He also requested to pay attention to “the needs of the poor, the weak and the vulnerable” and to really understand “that we are one single human family. There are no frontiers or barriers, political or social, behind which we can hide, still less is there room for the globalization of indifference.”17

Ban Ki-moon, former Secretary-General of the UN, the other transnational representative of the whole human family, appreciated the papal encyclical. He was looking forward to Francis’s scheduled address of the UN General Assembly in New York in September 2015.18 The conservative Washington Examiner, however, introduced the Pope as a “Latin American anti-U.S. populist” who had made “numerous vitriolic attacks on our economic system” and supported “many of the positions being taken by the Democrats’ left wing.”19

Inequality has been normalized in the Trumpian force field. Scientific findings are incessantly undercut by false conspiracies, untruths, and outright lies. For decades, Republicans have nurtured the misleading opinion that great wealth contributes greatly to economic growth. Yet sound economic research of wealth inequality from 1987 to 2002 revealed that billionaire wealth stunts economic growth.20 The study covered 1,652 individuals, each owning more than one billion dollars and actively involved in managing their fortunes. Furthermore, the study also found that politically connected billionaire wealth stunts economic growth significantly.21

Ban Ki-moon observed on World Day of Social Justice in 2014, “There is nothing inevitable about inequality.”22 He was right. Inequality is a social construction that can be deconstructed and reduced. Of course, any attempt to attack inequality requires a functioning administrative state with a democratically legitimized authority. Bannon’s project (the deconstruction of the administrative state) aims at disabling the very tool that is needed to increase economic equality.

The hurdles to fight inequality are formidable. Obstacles include humanity’s fragmentation into over 190 sovereign nation states, the geopolitical structure undergirding economic nationalism, and offshore tax heavens. Multinational corporations and superwealthy individuals are taking advantage of global loopholes via the flight of capital and by not paying their fair share of taxes.

A world authority which could effectively outlaw tax havens does not exist. Transnational regional integration, such as the European Union, could advance in this direction, but populism, Trumpism, and Putinism work against local and global integration. They seek to disintegrate the EU not to strengthen it. So, the question arises, how to domesticate nationalistic, egocentric, regional capitalisms for the benefit of small, individual taxpayers, poor families, and the planetary whole.

America is the nation that could and should put this question on the world’s agenda. Instead, Decius-Anton and Bannon whip up turbulent discontent on behalf of a populist scam. Sheltered from the deadly winds of inequality, they do mercenary work for the Trumps and Mercers of the world who already own half of the planet’s wealth.23

America was meant to be a republic of equals held together by collective solidarity.24 Yet a macabre coalition of top 1 percenters tries to teach 99 percent of society that solidarity is weakness. Why would you join a mutual health insurance pact, they ask, when you are young, strong, and healthy? Why make the weak strong, they say, and yourself weak by supporting the unsuccessful with your money?

Jane Mayer reported a conversation with a Renaissance insider who told her:

Bob [Mercer] believes that human beings have no inherent value other than how much money they make. A cat has value, he’s said, because it provides pleasure to humans. But if someone is on welfare they have negative value. If he earns a thousand times more than a schoolteacher, then he’s a thousand times more valuable.25

Thus spoke dark capitalism.

- Karl Marx, Capital: A Critique of Political Economy. Volume I, p. 542.

- See “Our Schumpeter columnist pens a dark farewell.” The Economist, 20 Dec. 2016. For the original, see Joseph A. Schumpeter, Capitalism, Socialism, and Democracy. New York, London: Harper & Brothers, 1942.

- China Daily, “Marketization the key to economic system reform.” Beijing, 18 Nov. 2013.

- See Jodi Kantor and David Streitfeld, “Inside Amazon: Wrestling Big Ideas in a Bruising Workplace.” The New York Times, 15 August 2015. The article details how white-collar workers are pressed to become “the best Amazonians they can be.”

- The Economist, 2 Feb. 2013, “The next supermodel: Politicians from both right and left could learn from the Nordic countries.”

- Proposed to the UN by Bhutan in 2011, the first World Happiness Report came out in 2012, subsequent reports and updates 2013, 2015, 2016, and 2017. Published by the UN Sustainable Development Solutions Network, the reports routinely survey over 150 countries. Update October 2020: I have enlarged Table 1 with the scores for 2018, 2019, and 2020.

- Jeffrey D. Sachs, “Restoring American Happiness.” World Happiness Report 2017, p. 178-184.

- For a detailed discussion, see Richard A. Easterlin, Fei Wang, and Shun Wang, “Growth and Happiness in China, 1990-2015.” World Happiness Report 2017, p. 48-83. Update October 2020: Table 1 shows that China’s positive trend stopped in 2017 and turned negative in subsequent years.

- Thomas Piketty, Capital in the Twenty-First Century. Cambridge, Mass. 2014, p. 297.

- For the share of the top 0.1 percent of US household wealth, see Emmanuel Saez & Gabriel Zucman, “Wealth Inequality in the US since 1913: Evidence from Capitalized Income Tax Data.” The Quarterly Journal of Economics, vol. 131, May 2016, issue 2, p. 519-578.

- Piketty, op. cit., p. 297.

- Piketty, op. cit., p. 264.

- Piketty, op. cit., p. 265.

- See above, chapter 6: Dark Free Speech, note 54.

- See Pope Francis, Encyclical Letter Laudato Si’. Rome, 24 May 2015.

- Ibid., paragraph 49, emphasis in the original.

- Ibid., paragraph 52.

- See UN Secretary-General, “Statement attributable to the Spokesman for the Secretary-General on the Papal Encyclical by His Holiness Pope Francis.” New York, 18 June 2015.

- Irwin M. Stelzer, “Francis in the Land of Savage Capitalism.” Washington Examiner, 11 Sept. 2015.

- See Sutirtha Bagchi and Jan Svejnar, “Does Wealth Inequality Matter for Growth? The Effect of Billionaire Wealth, Income Distribution, and Poverty.” Journal of Comparative Economics, vol. 43, no. 3 (2015): 505-30. “Our first set of findings suggests that wealth inequality tends to have a negative effect on economic growth, income inequality has no or at most a weak positive effect on growth, and the effect of poverty on growth is insignificant” (524). A Nov. 2013 version of this paper is available online.

- Ibid., p. 524: “Our second key finding is that when we enter politically connected and unconnected wealth as two separate explanatory variables into our regressions, our estimates suggest that it is politically connected wealth inequality that has a significant negative effect on growth, while the effects of politically unconnected wealth inequality, income inequality, and poverty are all insignificant.”

- UN Secretary-General, “Secretary-General’s message for the World Day of Social Justice.” New York, 20 February 2014.

- See Daniel Bentley, “The Top 1% now owns half the world’s wealth.” Fortune, 14 Oct. 2015; Richard Kersley and Markus Stierli, “Global Wealth in 2015.” Credit Suisse, 13 October 2015.

- See Ganesh Sitaraman, The Crisis of the Middle-Class Constitution: Why Economic Inequality Threatens Our Republic. New York: Alfred A. Knopf, 2017. For a review of this book, see Angus Deaton (Nobel Prize in economic science 2015), “It’s Not Just Unfair: Inequality Is a Threat to Our Governance.” The New York Times, 20 March 2017.

- Jane Mayer, “The Reclusive Hedge-Fund Tycoon Behind the Trump Presidency.” The New Yorker, 27 March 2017